Impact of Budget 2079-2080 on Business & Taxation

Finance Minister Janardhan Sharma presented the Budget of Nepal for the fiscal year 2079-2080 on 15th of Jestha, 2079. Finance Minister through this annual budget attempts for sovereign development and economic growth through consistency, increased productivity, and employment.

We have compiled all the facts from the Budget Speech and Financial Ordinance with respect to its impact on Business & Taxation.

Click the button below to download the Budget Summary of FY 2079-2080, Nepal or you can go through the whole article.

Objectives of Budget (based on the tax revenue perspectives)

- Development of a strong, independent, and improved economy through sustainable and effective tax operation

- Upliftment of domestic industries

- Broaden the scope of tax and control over tax evasion

- Make the Revenue system progressive, simple, transparent, and accountable by reinforcing the whole system.

- Increase the tax execution and tax participation through professional, clean and taxpayer-friendly tax administration

- Make the revenue administration technology-friendly.

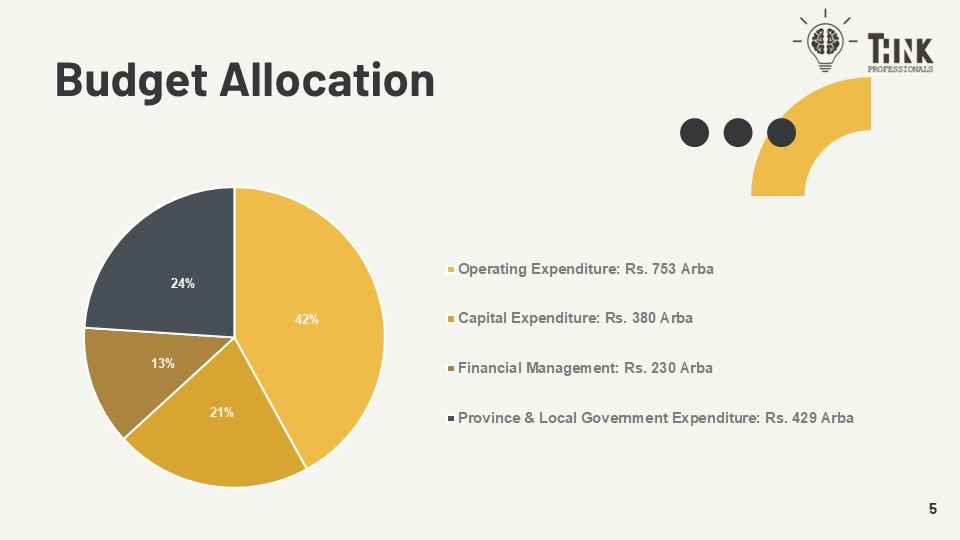

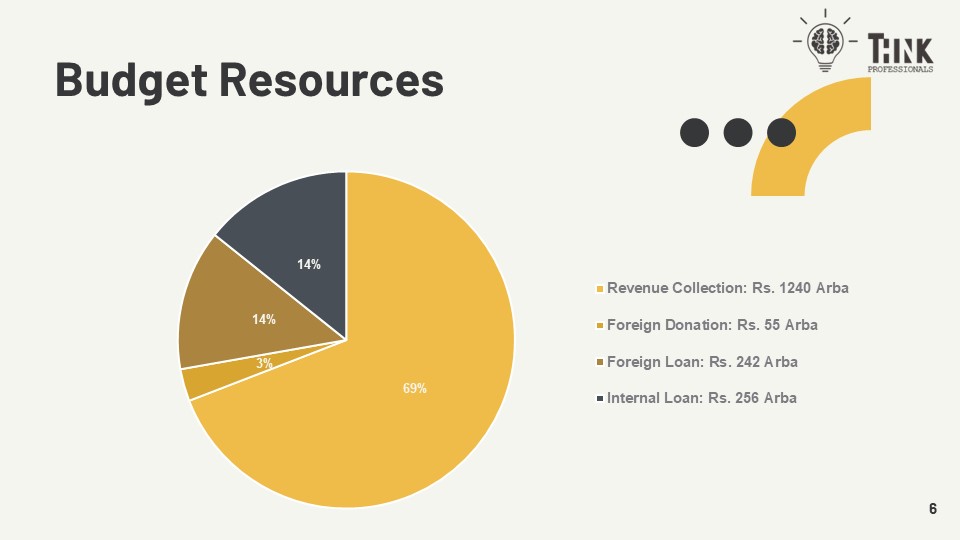

Budget Allocation & Resources

Tax Relief for FY 78-79

- D-01 Annual Transaction Volume upto 30 Lakhs u/s 4(4): 75% Rebate

- D-02 Annual Transaction Volume more than 30 lakhs and less than 1 crore u/s 4(4a): 50% Rebate

- COVID 19 affected businesses: Hotel & Tourism Industry [Party Palace, Film Industries (Production & Distribution), Trekking, Transportation]

- 50% Tax Rebate

- Registration & Renewal fees waived off 100%

Personal PAN and Personal Tax Clearance

- Will be arranged to be provided alongside with citizenship or National Identity Card

- Minor of Nepali Origin involved in business or investment activity: Personal PAN will be provided based on the Birth Certificate and National Identity Card of parents.

- Personal tax clearance is compulsory for:

- Renewal of visa and work permit for foreign nationals

- Renewal of registration for those involved in the business of providing professional services.

- Personal PAN is compulsory in case of purchase of 4-wheelers.

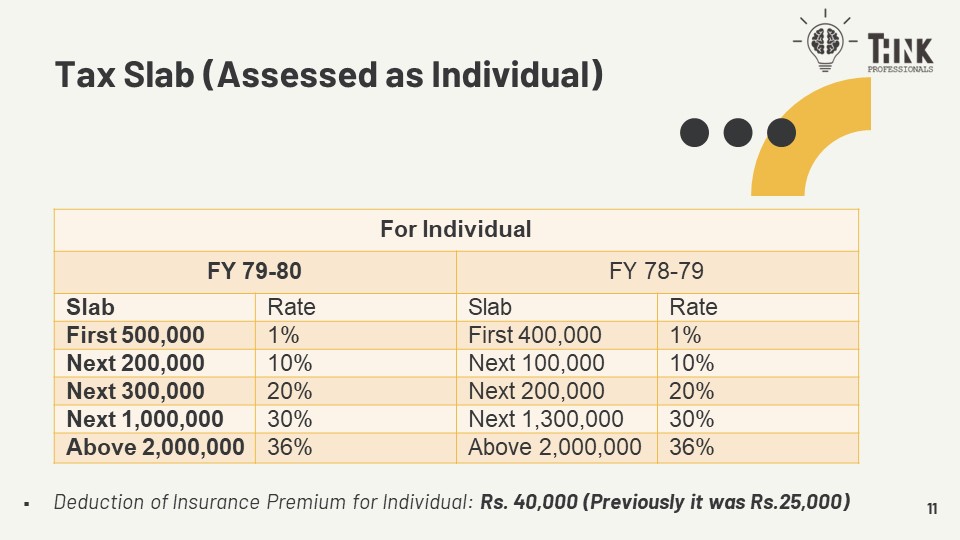

Revised Tax Slab

Vehicles: Exemptions, benefits and rebates

- Import of Raw Materials by an entity established for 4-wheeler production or assembly:

- 50%Concession on ExciseDuty(on the recommendation of DOI)

- 25% Concession on Custom Duty

- Import of Raw Materials or spare parts by entity manufacturing E-Rickshaw, E-scooter or E-bike: 1% Custom Duty

- The industry established within 2082 for manufacturing or assembling Electric vehicles: 40% rebate on Income tax for 5 years from the date of operation.

Agriculture: Exemption, benefits, and rebates

- Import of ONE Agricultural Ambulance or vehicle used for transportation and marketing of the agricultural products by local level: 100% concession on custom duty

- Import of ONE vehicle used for transportation of agricultural product by agricultural cooperative organizations: 50% concession on Custom Duty

- The industry was established within 2082 for manufacturing agricultural tools and equipment: 100% tax exemption for 5 years from the date of operation.

- Firm, company or cooperative society involved in agricultural business, dehydrated vegetable and cold stores: 100% rebate on Income Tax (Proviso to Sec 11(1))

Sanitary Pad: Exemption, benefits, and rebates

- Import of Sanitary Pad: 90% rebate on Custom Duty

- Import of Raw Materials by the manufacturer of Sanitary Pad: 1% Custom Duty

- Industry producing health vaccines, oxygen gas, and sanitary pad:

- 100%TaxExemption for the first 5 years (Previously it was 3 years) from the date of production.

- 50% Tax Exemption for the next 3 years.

Exemptions & Benefits on Imports

- Import of 2 school buses by Community or Public School: 75% rebate on Custom Duty

- Import of raw materials by manufacturers producing goods used by differently-abled persons: 100% Exemption on Custom Duty (Recommendation of DOI)

- Import of Urine Bag used by differently-abled: 100% Exemption on Custom Duty

- 100% waiver on Custom Duty, Excise, and VAT: Import of Machinery or equipment within FY 2079-80 by:

- Entity manufacturing vaccines

- Entity manufacturing liquid-oxygen

Exemptions on Exports

- Tax Exemption on income earned from export:

- In case of Individual tax payer: If tax is chargeable at 20% – 25% tax exemption, if chargeable at 30% – 50% tax exemption

- In case of entity: 20% of applicable tax rate

- Additional 50% (Previously it was 30%) in case of the export of goods produced by a production-based industry after the above-mentioned deductions.

- Cash Subsidy of 8% for export of High end potential junk clinker, cement, steel, hardware, prototyping & outsourcing services.

Exemptions & Rebates for protection of Tax Payers

- Operation of Industry in Hilly region of Sudur Paschim and Karnali Province providing direct employment of more than 100 people: 100% Tax Rebate for 15 years from the date of operation.

- Entity Commencing commercial production, transmission or distribution of hydropower, electricity produced from solar, wind and biological substance by Chaitra of 2082: 100% Tax exemption for first 10 years and 50% rebate for next 5 years

Broadening of Scope of Tax

- Partnerships firms: under the purview of Sec 57 (Change in ownership)

- Royalty paid to writers for their literatures and compositions: 1.5% TDS

- Introduction of DigitalServiceTax

- Non-Residents providing digital services to Nepalese : 2% on all digital services

- Services up-to 20Lakhsare exempt.

- Non-Residents providing digital services having turnover of more than 20 lakhs in past 12 months: Compulsory registration under VAT

- Acquiring Foreign currency by Export of Software, Electronic services, Business Process Outsourcing and similar types of services related to information technology like cloud computing and software programing: 1% tax on such income earned.

- TDS of 1% by BFI on the FC received by any person not involved in business activities (freelancer) for:

- software service or electronic services provided to foreign country,

- consultancy services in foreign country

- uploading the audio-visual materials in social media.

- Cinema Development Fees on every tickets of foreign movies: 15% in case of normal tickets and 20% in case of cabin tickets.

- Capital gains on sale of land & Building:

- Period of holding more than 5 years – 5%(Previously it was 2.5%)

- Period of holding less than 5 years – 7.5%(Previously it was 5%)

- Income tax on cooperatives registered under the Cooperatives Act:

- 7.5%in case of municipality (Previously it was 5%)

- 10% in case of Sub metropolitan Municipality (Previously it was 7%)

- 15%in case of Metropolitan Municipality (Previously it was 10%)

- Increase in excise duty for products like liquor, non-alcoholic beverages, tobacco, etc. Several new items have been added to the list of excisable items.

- Increase in import duty for products like tobacco, hookah flavors, tomato ketchup, etc. There has been changes in various other harmonic codes.

- (Note: Need to check products and HSN Code individually wherever and whenever required)

Waivers

- Any registered firm and any company, who have not submitted annual returns or have not renewed the firm registration up-to FY 2076-77, will be waived off 95% of the fines and penalties if annual returns and balance 5% of fine and penalties will be paid by Poush Masanta 2079.

- Any person earning taxable income without paying any tax will be waived off all the past taxes, interest, fines and penalties if he registers himself under the Income tax and file the annual return and pay respective taxes for FY 2075-76, FY 2076-77 and FY 2077-78 by Poush Masanta 2079.

- For person paying tax as per Section 4(4) & (4ka) (D01 & D02) who have filed a different income than the actual income upto FY 2077/78, opt to file the correct income by Chaitra 2079 for each year separately will need to pay only 1.5% income tax on the differential amount.

- JVs having required to file their VAT returns and pay the payable VAT thereto upto Chaitra masanta 2078, files the VAT returns and pays VAT payable and 50% of interest thereto by Poush Masanta 2079, all additional fines and penalties will be waived off.

- Assesses required to file Excise returns and pay the payable VAT thereto upto Chaitra masanta 2078, files the Excise returns and pays the Excise Duty payable and 50% of the Late fine on such delayed payment by Poush masanta 2079, all fines, penalties and balance late fines will be waived off.

Other Miscellaneous Privileges

- Nepalese citizens employed in foreign will receive 50% concession on fees for Passport Renewal, Consular Services and renewal for work permit if they use formal channel for the remittance of funds.

- Telecom & Internet Service Charge reduced to 10% from 13%

- Payments made by transportation agencies to non-registered vehicle owners even without bill will be an allowable expense if TDS is deducted as per Sec. 88(1)(8) only for the FY 2077/78.

Other Related Provisions

- 100% additional registration fees if a single person acquires more than one house or apartments

- Casino Royalty increased to 5 cr from 4 cr (1.5 cr against 1 cr for such games which are played through modern machines or equipment)

- Minimum FDI Capital Requirement reduced to Nrs. 20 million from Nrs. 50 million

- 10% reservation in IPO for Nepalese residing outside Nepal for employment

- Senior citizen age has been reduced to 68 years from 70 years for social benefits.

Click the button below to download the Budget Summary of FY 2079-2080, Nepal.

Previous Post

Previous Post